Real-Time Business Verification, Compliance & Credit Risk Platform for Lenders Banks Insurance Fintech Payments

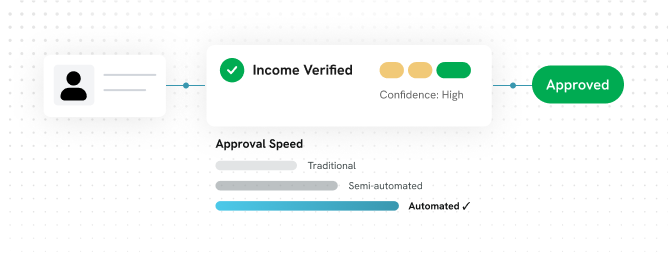

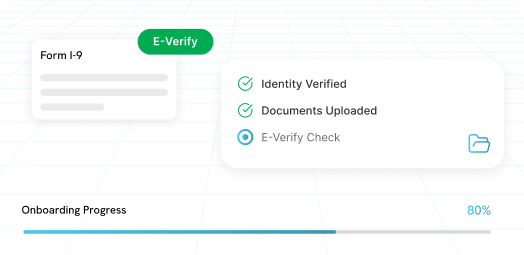

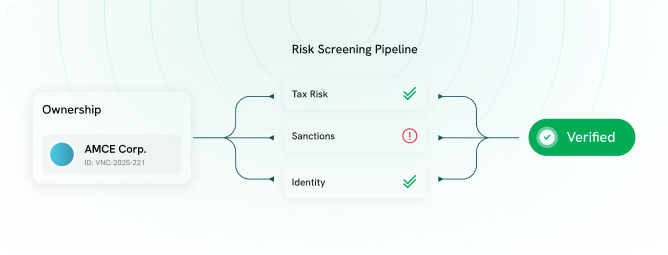

Compliancely gives your business reliable insights via API or dashboard, unifying credit risk, identity and employment checks in one secure, agentic platform so you can cut manual review, onboard customers faster and stay audit ready

Powering 75M+checks & business verification every year!