Seamless risk and compliance automation that helps insurers verify policyholders and prevent fraud, from quote to claim.

Compliancely integrates seamlessly into your existing policy admin systems & workflows to automate verifications and give you reliable results in real-time.

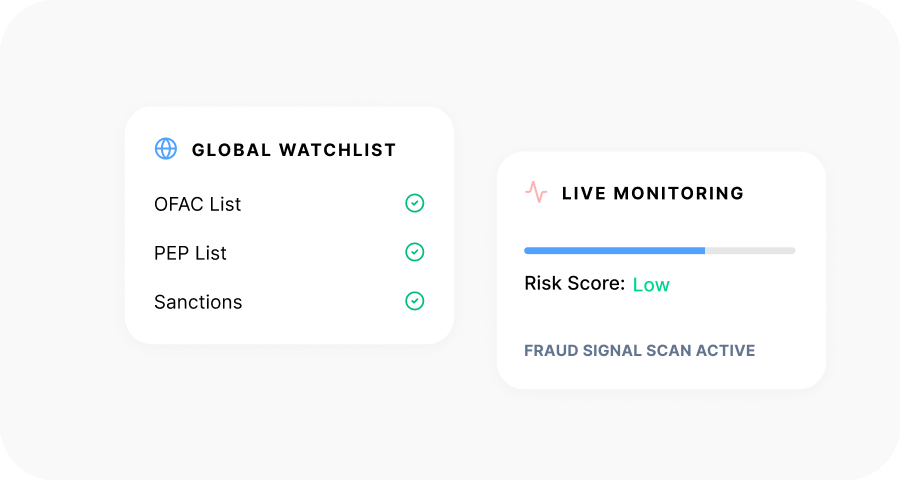

By continuously verifying data and running required compliance checks in the background, we help you stay aligned with regulatory changes.

Customers expect a smooth, digital-first insurance experience. Compliancely offers frictionless digital verification during onboarding and claims.

Uptime Guarantee

Customer Support

Support Staff

Reduce exposure to fake identities, ghost brokers, and fraud by verifying identity and taxpayer information of policyholders, beneficiaries, claimants, and agents at onboarding and throughout the policy lifecycle.

Access tax transcripts in two hours to support income verification for underwriting and high-value policies. Improve risk assessment, price policies correctly & maintain strong compliance practices.

Screen policyholders, beneficiaries, vendors, and partners against global sanctions and watchlists, including DMF, to meet regulatory expectations and manage benefits more effectively.

Strengthen compliance across underwriting and policy administration by verifying that businesses are properly registered using direct-source verification and 360-degree risk profiles.

See how lenders, marketplaces, HR teams, and compliance leaders use Compliancely to move faster with confidence.