Prevent fraud, onboard faster, and meet international regulations at scale by automating KYC, AML, CIP, and merchant verification with real-time checks.

When onboarding takes too long:

Get access to a fast, low-friction onboarding experience. We help payment providers onboard merchants quickly and confidently with real-time identity verification, IRS TIN Match, and automated regulatory screening.

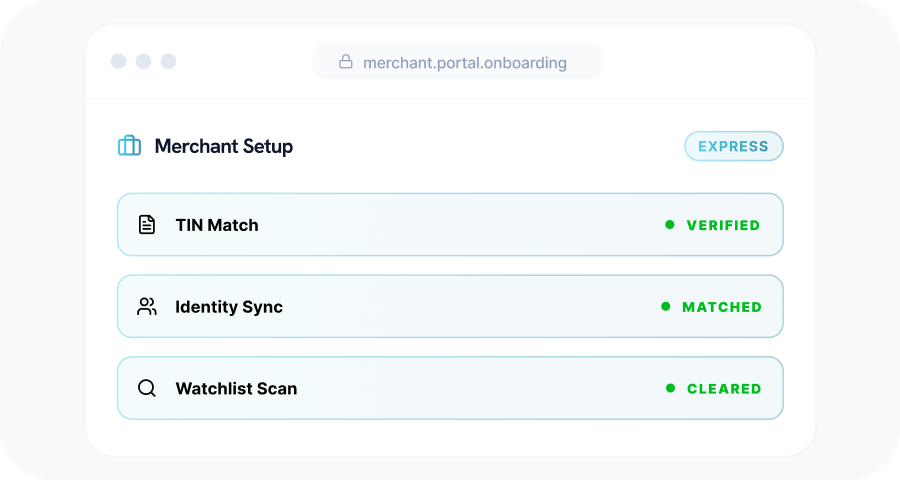

Automate TIN Match, identity verification, and watchlist screening and get real-time results, so merchants can get approved faster, and processing can start sooner.

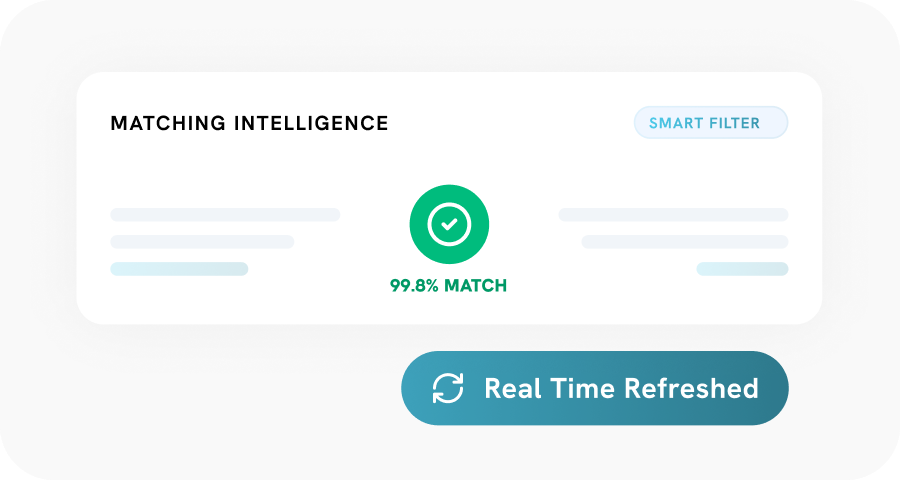

Reduce false matches and avoid onboarding slowdowns caused by outdated data. Real-time verification helps you onboard more legitimate merchants with fewer exceptions and less manual review.

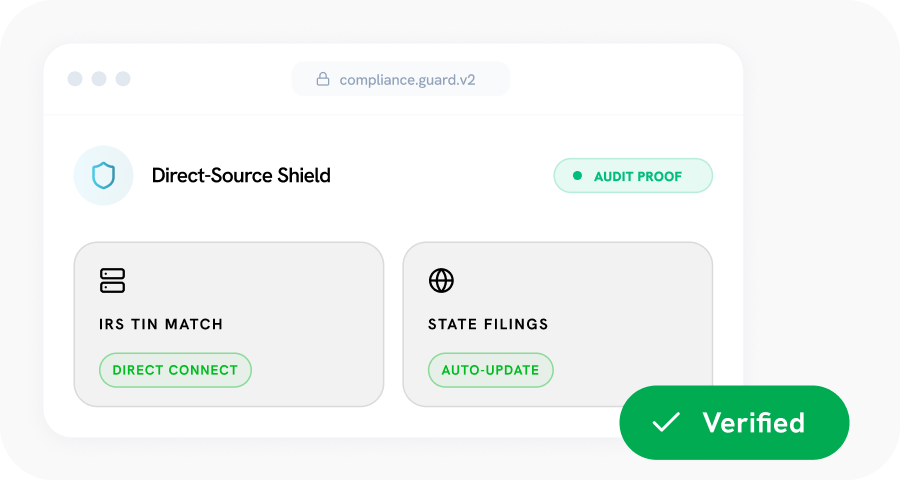

Use direct-source verification and consistent automated checks to reduce audit risk and prevent expensive compliance failures, without slowing down growth.

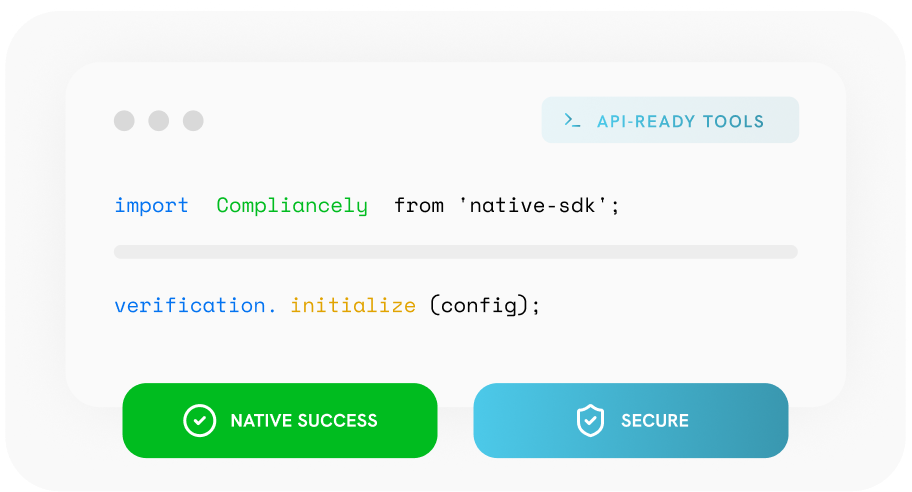

Modern fintechs need compliance to feel native, not bolted on. Our API-ready tools let you embed automated checks into every event.

Uptime Guarantee

Customer Support

Support Staff

We combine real-time identity verification with IRS TIN Match to verify merchants in seconds while meeting strict regulatory expectations (KYC, AML, and CIP) and tax compliance needs.

Screen merchants against global sanctions and watchlists (including OFAC and FATCA) to reduce exposure to high-risk entities and strengthen AML controls.

We integrate into your existing onboarding and payments systems to automate KYC/KYB/TIN and screening checks without manual back-and-forth, helping your teams scale efficiently while staying compliant.

See how lenders, marketplaces, HR teams, and compliance leaders use Compliancely to move faster with confidence.