Compliancely powers businesses with real-time TIN validation and verification, creating a hassle-free roadmap to compliance.

Businesses like you are using Compliancely to validate vendor lists and customer data right from the get-go. Start thriving with Compliancely – a powerful IRS compliance tool.

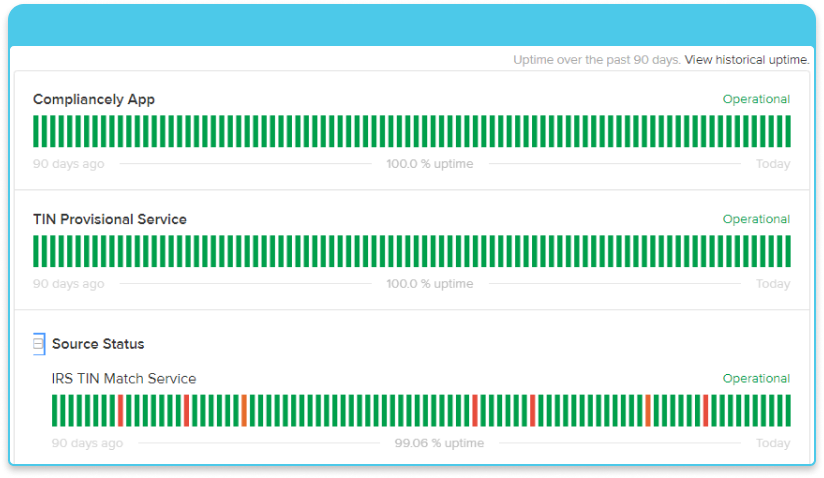

Onboard more customers with our most reliable and user friendly API. With features like 365 days uptime, easy and seamless integration, workflow automation empower your teams to serve more customers

Compliancely updates its database as and when the IRS updates its records, helping you validate the TIN/Name combinations in real-time. We continuously update our databases to provide you the latest, most recent data lists

Compliancely enables you to verify thousands of TINs at once with its bulk TIN Matching service, helping you add only the verified vendor profiles to your master file. Additionally, validate vendor lists at the start of the tax year and avoid the year-end rush.

If you’ve been in the industry long enough, you must know that the IRS does not hold back when it observes non-compliance. Avoid being issued B-Notices and prevent penalties with Compliancely’s real-time TIN Matching API.

Compliancely is an IRS-authorized business identity infrastructure, working to help businesses ensure 360° business compliance. You can validate TINs, conduct hundreds of identity checks, and gain additional insights about your vendors.

With Compliancely, you’re not just ensuring tax compliance for your business, but you’re also strengthening your vendor associations, making well-informed decisions, and fostering growth.

To put it simply, you’re assessing your vendor alliances in real-time with this powerful identity API.

Free Sign-up

Associating with businesses that practice false positives may bring havoc to your business. Avoid being penalized and conduct a variety of compliance checks to verify an entity and its operational presence.

Before you add a new vendor to your master file, take the time to identify and verify their history to ensure that the association is safe for you and your business.

Start Bulk TIN Checks For Your Business Today

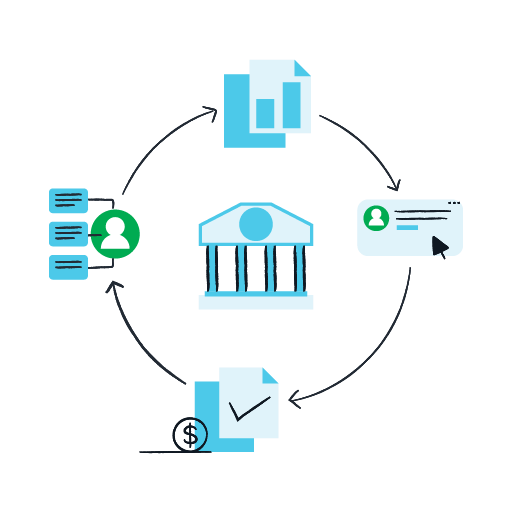

On your Compliancely dashboard, click on the ‘TIN Match’ check and enter the TIN/name combination provided to you by the vendor. You’ll be able to view the results in seconds per the IRS records.

If your business has been issued a taxpayer identification number or an employer identification number, then you must verify the identification code and cross-check if the IRS has recorded your details accurately. You must also renew it as recommended by the IRS, and provide accurate information to the requested parties.

Compliancely continuously updates its databases and lists in accordance with the authorized government organizations, allowing users to identify and validate information about their customers, vendors, and entities in real-time.

Yes. Compliancely is an IRS-authorized tax compliance enabler, helping businesses and self-employed individuals with TIN Matching and other business identification requests.

Create your account by registering with your phone and email address. Authenticate your account to secure it and furnish your business information. Your business can be enrolled once you verify your business information.

You can integrate Excel or any of the available data management applications with Compliancely to sync your data. Select ‘Bulk TIN Match’ from your Compliancely dashboard and the vendor data validation process will be accelerated automatically.

If the provided information does not match the IRS records or if your request renders an invalid response, it means that the vendor must have provided you incorrect information. Follow up with your vendors and send a W-9 to obtain the correct information.

A successful TIN Match means reporting returns with the correct tax identification information. This allows the IRS to identify and track the payer and the recipient entities, eliminating room for corrupt tax practices. By conducting TIN Matches, you’re facilitating compliance, thereby staying in the good books of the IRS.