The FATCA List, or the Foreign Account Tax Compliance Act List, is a vital tool for businesses and individuals alike.

It's a registry of foreign financial institutions and their account holders.

FATCA was established to prevent tax evasion and ensure compliance with U.S. tax laws by requiring foreign financial institutions to report information about accounts held by U.S. taxpayers.

Find out if your desired business name is ready for registration. Ensure it stands out and represents your vision.

Gain clarity on the types of accounts subject to FATCA requirements. Knowing these categories is vital for ensuring your financial compliance.

Explore the global jurisdictions where FFIs are located. This insight aids in understanding the international scope of FATCA compliance.

Learn about FFIs' compliance statuses. This information is crucial for evaluating the adherence of foreign institutions to FATCA regulations.

Understand whether the U.S. has reciprocal agreements with other countries. This insight can impact the reporting obligations of FFIs

Explore how FATCA regulations might affect investors with foreign assets. This insight is essential for individuals and businesses with international financial interests.

Access valuable resources to guide your FATCA compliance journey, ensuring you navigate tax regulations effectively and efficiently.

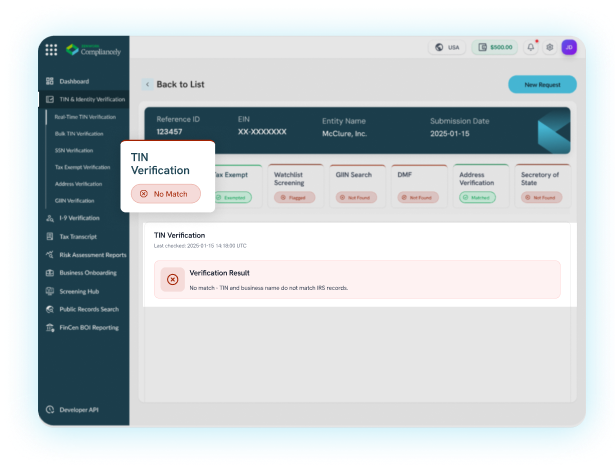

Ensure full compliance with FATCA regulations, minimizing the risk of penalties and legal complications.

Proactively identify and mitigate risks associated with foreign financial accounts, protecting your financial interests.

Gain a comprehensive view of your international financial holdings and obligations, ensuring transparent financial reporting.

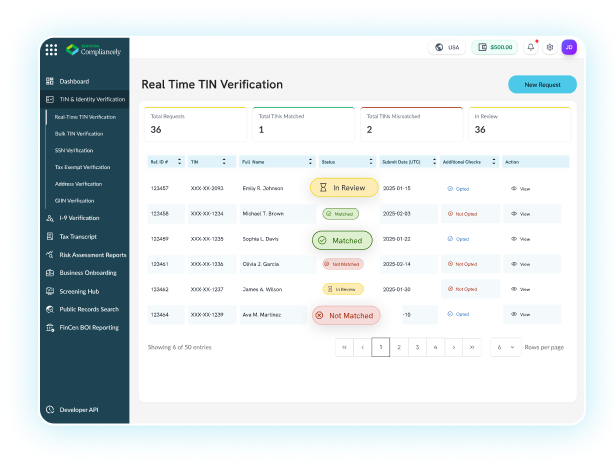

Streamline your reporting processes, saving time and resources while meeting FATCA requirements.

If you're involved in international business, FATCA List verification helps you navigate complex tax obligations.

Knowing your financial affairs are in compliance with FATCA provides peace of mind, reducing stress and uncertainty.

Scale your business with trusted, easy-to-access products.

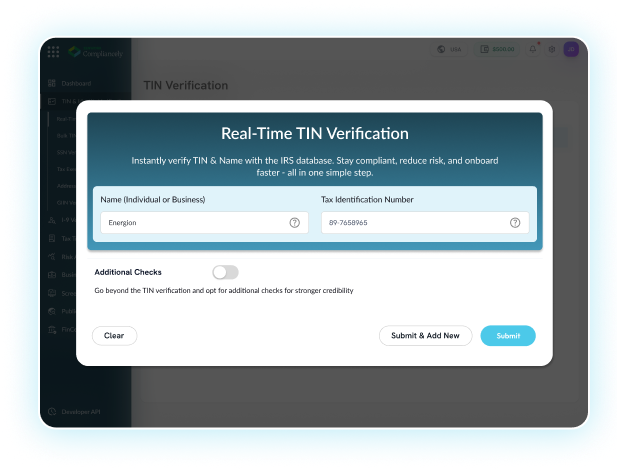

Trust in our identity verification against direct source for accurate and reliable results.

We ensure your access to our services with an outstanding uptime of 99.9999%.

The platform is built with enterprises grade security to ensure your data is processed securely.

Leverage our API and plug & play widgets to easily integrate into your existing workflows and automate seamlessly.