Powering 75M+ checks & business verification every year!

Streamline compliance from the start and confidently onboard individuals/businesses with real-time access to trusted identity, employment, and business verification data, all in one seamless platform.

Get a complete and accurate picture of all your financial and compliance risks so you can make smarter, safer decisions. Evaluate tax, identity, and business signals while staying compliant with regulations and reducing audit exposure.

Stay compliant and protected with automated real-time alerts and ongoing screening against major global sanctions, watchlists, FATCA changes, BOI updates, and other key regulatory indicators.

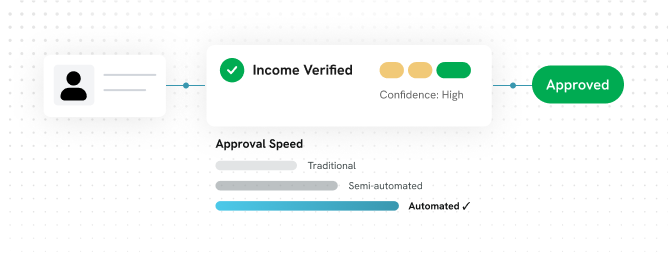

We give lending and credit teams verified income, identity, and tax-risk data to approve loans confidently and automate underwriting, to deliver a faster, smoother borrower experience.

Explore Lender Solutions

From identity and employment checks to sanctions and tax-risk monitoring, we strengthen your compliance posture across the board.

See action

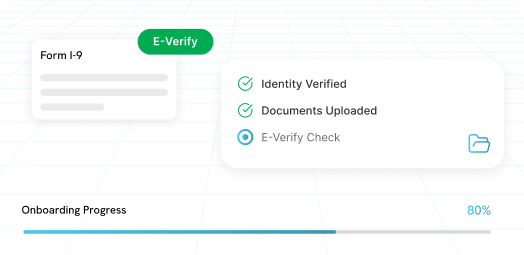

Streamline your hiring process with automated I-9 and E-Verify, centralized document storage & real-time verification tracking, in one modern dashboard.

See action

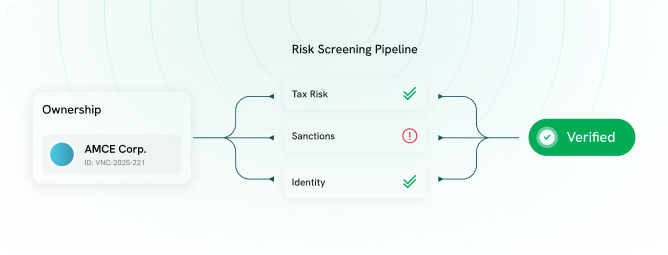

Protect your platform by onboarding only trusted vendors. Compliancely screens tax-risk, sanctions, business identity, and ownership signals to keep bad actors out of your ecosystem.

Enhance Vendor OnboardingSee how lenders, marketplaces, HR teams, and compliance leaders use Compliancely to move faster with confidence.

Get accurate, reliable data checks backed by government data.

Request a Demo