Designed for US businesses for fast and accurate BOI filings.

Starting January 1, 2024, most companies created in or registered to do business in the U.S. are required to report information on their Beneficial Owners to the Financial Crimes Enforcement Network (FinCEN) under the Corporate Transparency Act (CTA).

The Act attempts to prohibit the misuse of corporations and limited liability organizations for illegal benefit, including money laundering, fraud, financing of terrorism, and other activities. Companies are mandated to declare their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

There are 23 categories of entities that are exempt from BOI filing.

Our platform reduces the time required to complete BOI reports — from hours to mere minutes per client.

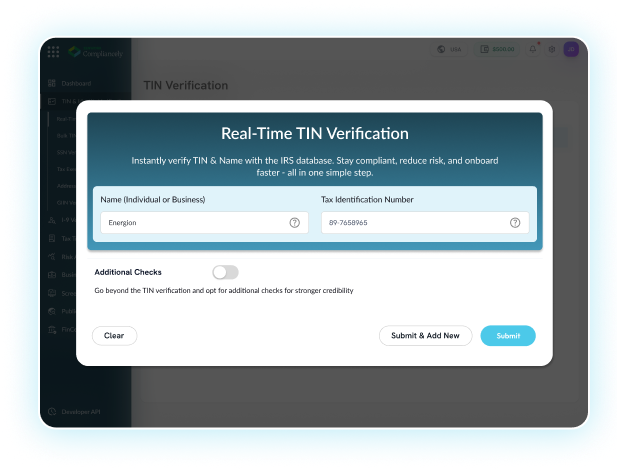

With Compliancely, you can quickly send “request info” links to your clients via email, leading them to provide all the necessary details.

The fast and automated bulk importing process of Beneficial Owners’ data entry can save you hours on each filing.

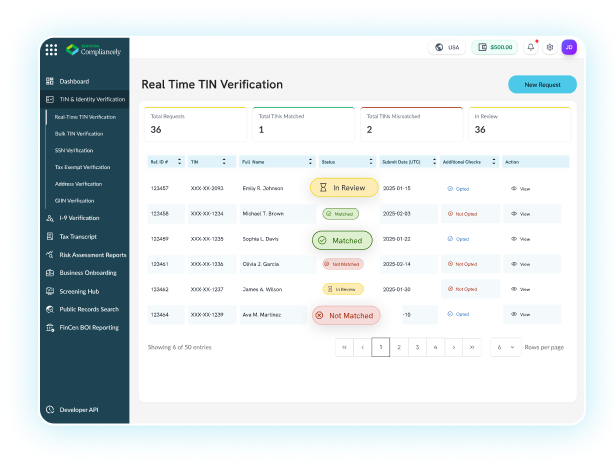

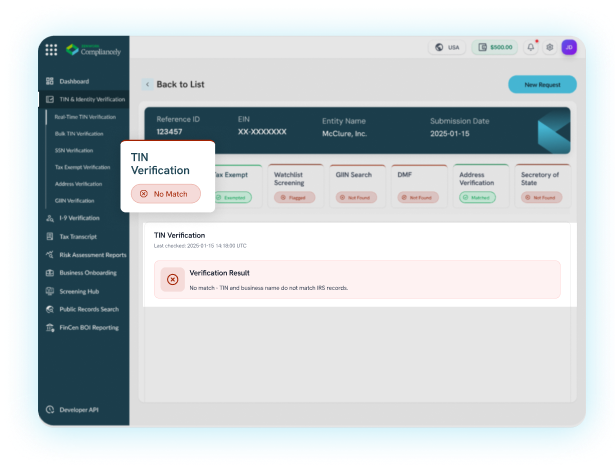

You can have a collective view of your filings at one place. Easily track the status of each report, identify those in progress or those successfully filed.

Effortlessly generate and submit both Initial and Updated BOI Reports. If changes are needed, you can also file a Corrected BOI Report with Compliancely.

When it comes to your filing records, make sure to keep them safe. Compliancely allows you to store and access all prior filings from one location for up to 3 years.

Doubts? We have the Answers.

A beneficial owner is an individual who either directly or indirectly:

(1) exercises substantial control over the reporting company, or

(2) owns or controls at least 25% of the reporting company’s ownership interests.

You need to report the following details in the BOI report: