Speed up your decision-making process by utilizing IRS tax transcripts, enabling you to assess credit risk in as little as 10 minutes*.

IRS tax transcripts provide IRS-verified financial information about a taxpayer or an entity. The tax transcripts show income data, filing and return status, balance due, or tax history. With Compliancely, get access to accurate and concise tax data straight from the source. We automate the entire tax transcript retrieval process, from e-consent & e-signature collection to verified transcript delivery and monitoring.

Provides individuals and businesses with a secure and compliant way to access their official IRS tax information.

Continuous transcript tracking monitors and alerts you of any changes in IRS activities.

Automate the entire tax transcript retrieval process from start-to-finish.

Prevent errors and increase transcript retrieval speed with smarter data validation.

Access accurate and tax data directly from the IRS to make data-backed decisions.

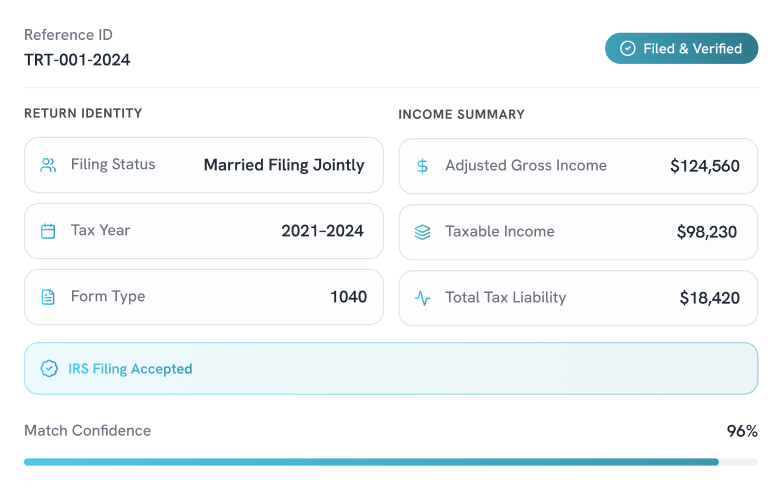

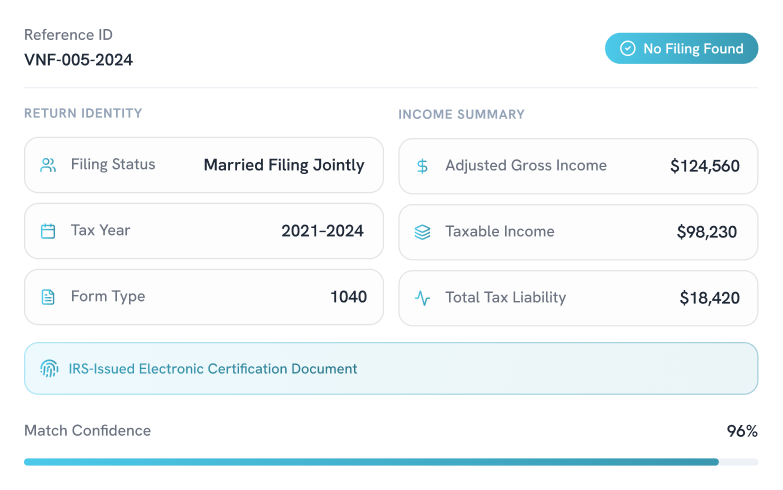

A summary of the original filed tax return covering filing status, AGI, and most line items for 4 years.

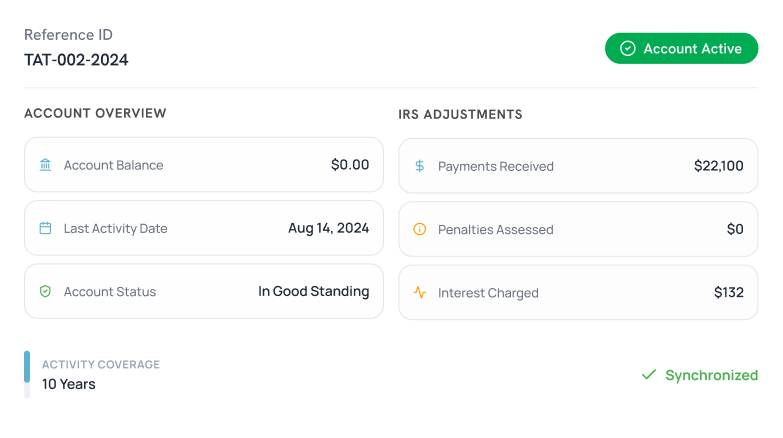

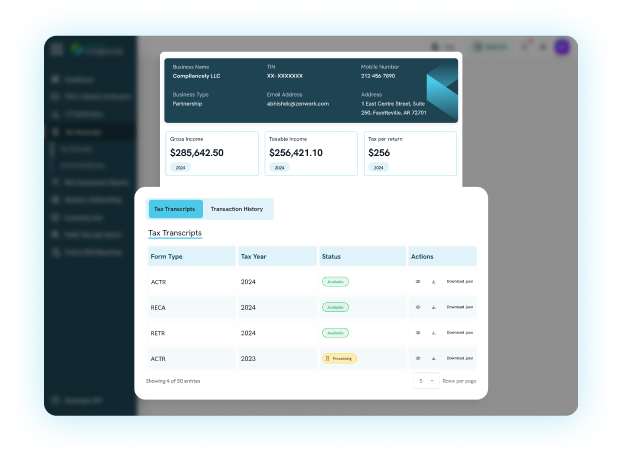

Shows full IRS account activity including adjustments, payments, and penalties for up to 10 years.

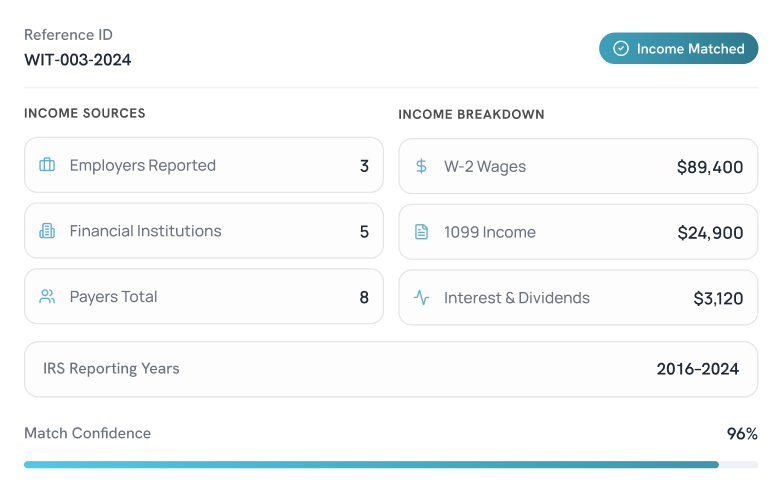

Provides 9 years of IRS-reported income from W-2, 1099, and other forms.

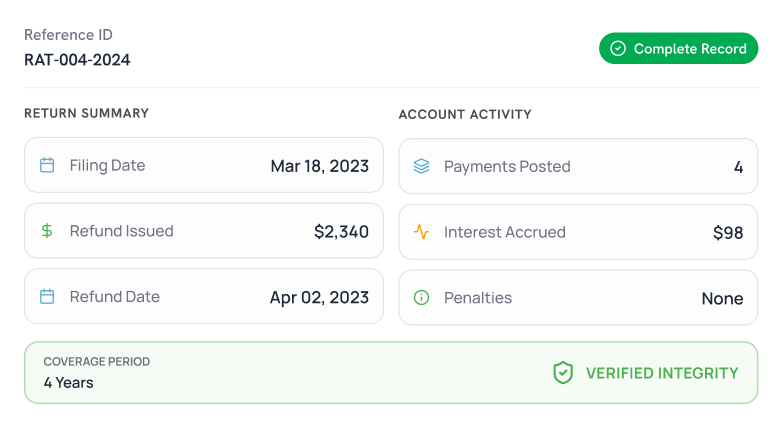

Detailed transaction history including payments, refunds, interest, and penalties.

IRS confirmation that no tax return was filed for the selected year.

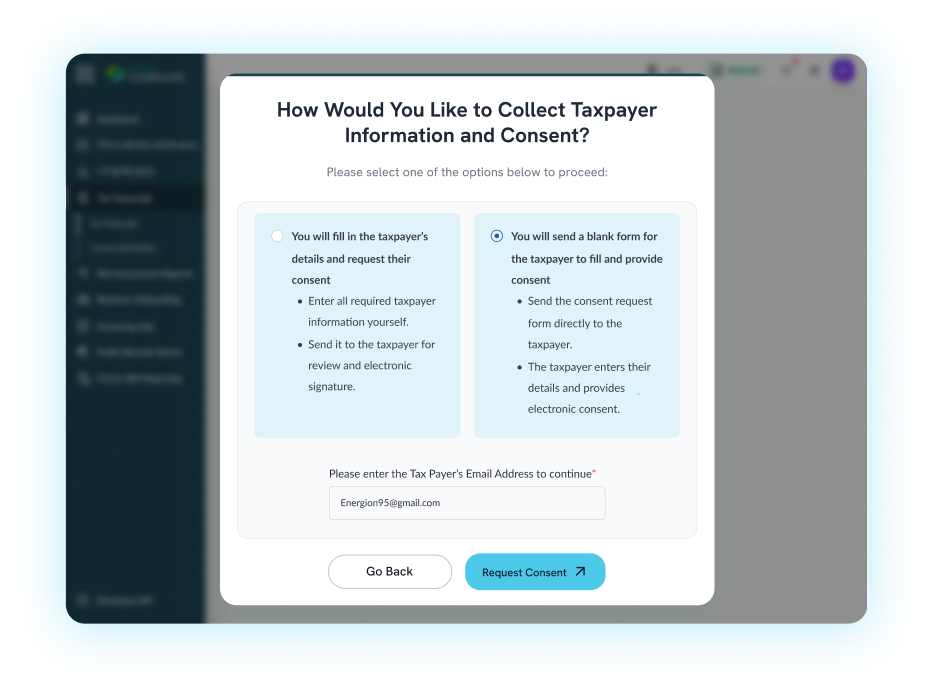

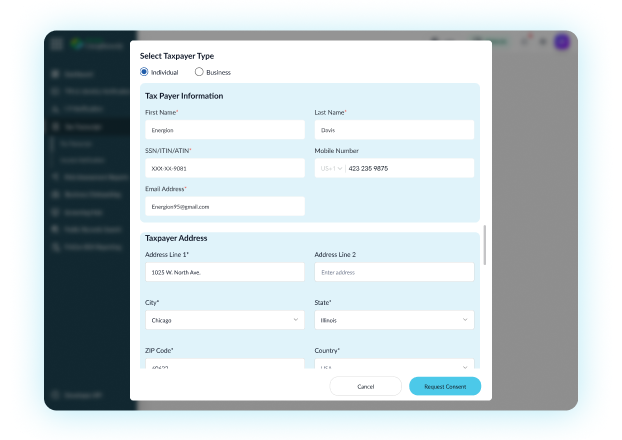

Auto-prepares the required IRS-authorization forms using e-consent templates and pre-filled links.

Collect applicant signatures on IRS consent forms digitally without any manual effort from your end.

Retrieve up to 10 years of tax account & wage/income transcripts and up to 4 years of tax return & record of account transcripts.

Combine identity verification, KYC/AML screening, and tax-transcript retrieval in a single workflow.

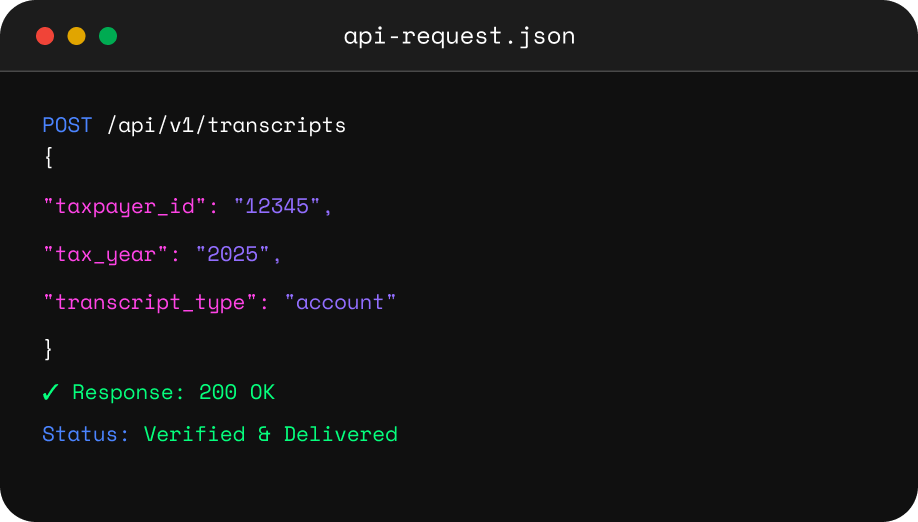

Plug our API and widgets into your existing system to automate transcript retrieval and consent collection.

Maintain complete logs and time-stamped activity for audit-ready IRS tax transcript compliance.

Use our free I-9 risk calculator to help you:

Integrate IRS tax transcript directly into your workflow.

Protect sensitive tax data with SOC 2 compliance and encryption.

Ensure uninterrupted service with 99.99% uptime.

Everything You Need to Know

IRS tax transcripts are detailed summaries of a taxpayer's return information provided by the IRS. The document offers a summary of your financial history, including income, tax returns, and adjustments made. It serves as a crucial record for businesses and individuals for various financial and compliance-related decisions.

IRS Form 4506 is a request form that you can use to request a copy of your tax return or designate a third party to receive the tax return.IRS Form 4506 is a request form that you can use to request a copy of your tax return or designate a third party to receive the tax return.

IRS Form 4506 is used to request a full copy of a tax return. While IRS Form 4506-T or Request for Transcript of Tax Return is used to order a free IRS tax transcript, which summarizes the tax return information. And, IRS Form 4506-C or IVES Request for Transcript of Tax Return, is meant for authorized third-party users who are participating in the IRS Income Verification Express Service (IVES).

4506-C gives IVES participants (like lenders) the authority to receive tax transcripts on behalf of taxpayers while 8821 authorizes a third-party to access tax information via TDS.

IRS transcripts can be delivered online using IRS "Get Transcript Online" tool, by mail via "Get Transcript by Mail" or Form 4506-T/C, or directly via an authorized third party.

You can get up to 10 years of data when requesting tax account and wage/income transcript with Compliancely. For other transcripts like tax return transcripts or record of account, you can request up to 3 years of data (plus current year data).