Onboard customers faster and stay compliant with our robust and flexible verification platform that adapts to evolving banking regulations.

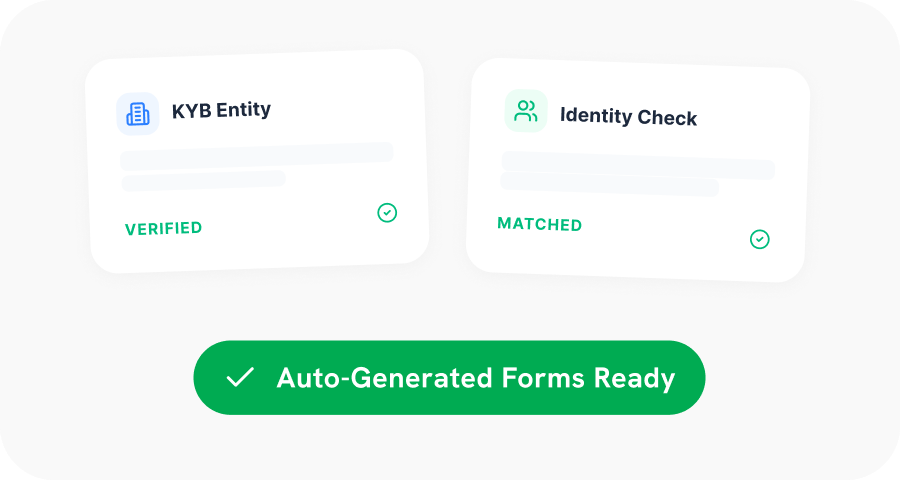

Onboard more customers without compromising on compliance with automated entity verification.

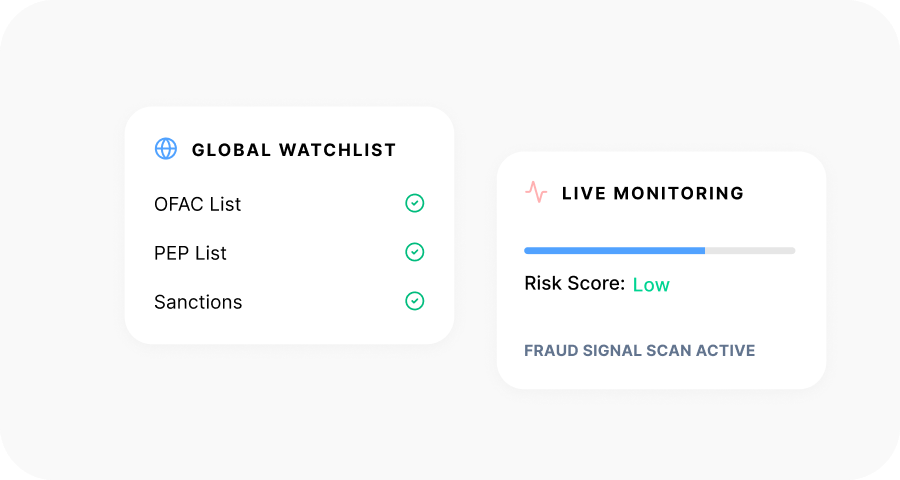

Identify high-risk customers early by screening against global watchlists and authoritative data sources.

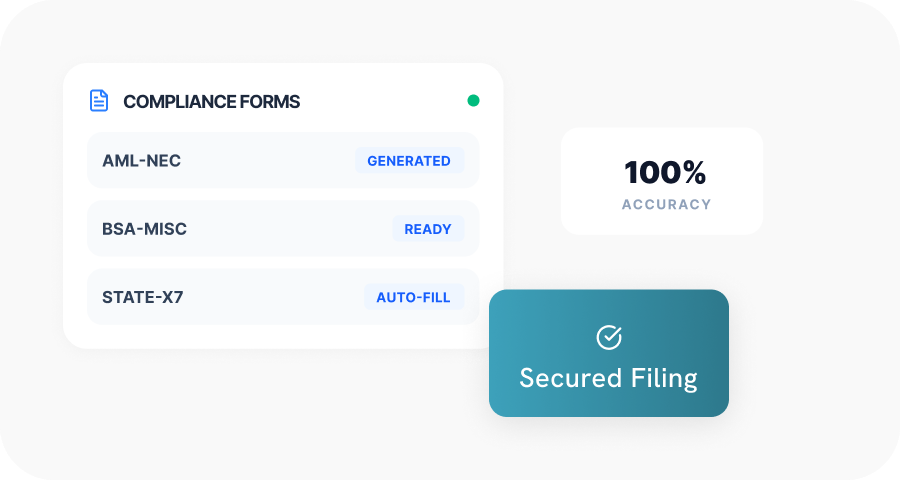

Stay compliant with automatic risk preparation and submission across federal and state requirements.

Reduce compliance costs and burden by automating routine verification and risk scoring tasks.

Uptime Guarantee

Customer Support

Support Staff

Learn more about your business customers before onboarding them. Business Verification helps banks meet BSA and AML customer due diligence requirements by verifying their legal existence, registration status, ownership structure &controlling persons by authoritative data sources.

Banks need to comply with OFAC and global AML requirements. Protect your institution and avoid sanctions violations by identifying prohibited or high-risk individuals and entities at onboarding and through ongoing monitoring.

Validate TIN directly against IRS records to support Customer Identification Program (CIP) and tax reporting accuracy. This reduces data errors, compliance gaps, identity mismatches that may occur, and makes onboarding easier.

Meet Customer Identification Program (CIP) requirements by automating individual identity verification during onboarding. This check lowers the risk of identity fraud, reduces manual errors, and provides documented evidence of compliance for regulatory reviews.

We enable banks to identify high-risk customers early. Automatically score and categorize customers based on risk for a regulator-approved, risk-based approach to compliance to enable due diligence on higher-risk customers while streamlining approvals for low-risk accounts.

Integrate compliance checks directly into your existing banking infrastructure, including core banking and onboarding systems, with our RESTful APIs. It helps banks maintain performance and regulatory control for high-volume environments without any disruption.

See how lenders, marketplaces, HR teams, and compliance leaders use Compliancely to move faster with confidence.