Top 5 EIN Verification Tools

EIN verification is mandatory for businesses filing 1099 forms and other informational returns. And to do this verification process, you need tools that can run IRS TIN Matching for EIN/name combinations against IRS database.

Let’s take a look at the best EIN verification tools in the market right now and how you can use them to reduce the chances of notices and penalties.

Why Do You Need EIN/TIN Verification Tools?

Every business in the U.S. requires an EIN (Employee Identification Number). This unique nine-digit number is used to verify that a business is legit and is also important when filing informational returns.

The IRS maintains its own name/TIN database. So, before you start filing 1099s, payroll tax forms, etc., you must verify that their EIN and legal name match the information the IRS maintains.

That’s where specialized EIN verification tools come in. These platforms provide a secure EIN verification workflow that reduces the chances of rejected forms, B-notices, and penalties.

Note: As per TIN name match pass/fail rules, if the EIN matches the data stored by the IRS, you can continue filing without any issues. But if it fails, you are required to start backup withholding and request for an updated W-9 form with the correct EIN from the payee.

EIN Verification Buyer Checklist

Before selecting an EIN verification tool, you must make sure the tool has the following features:

| Feature | Description |

|---|---|

| Coverage & Speed | Offers bulk uploads via file uploads or API integration with fast turnaround for bulk filings |

| Audit Trail | Maintains detailed logs of requests and responses along with timestamps |

| Simple UI + Developer Docs | Offers a user-friendly interface and comprehensive developer documentation |

| Security | Securely handles encrypted data along with role-based access |

1. IRS TIN Matching Program

The IRS TIN Matching program is a direct way to check if name and TIN matches IRS records without use of any other third-party platforms. Since it connects you straight to the IRS system, it’s considered the most authoritative source.

Standout Features:

- Authoritative match: Accurate results for name + TIN direct from IRS database.

- Interactive TIN Matching: Runs up to up to 25 checks at a time with immediate results.

- Bulk TIN Matching: Upload up to 100,000 checks at once with next day results.

- Free to use: No requirement for any payment.

Things to keep in mind:

- Only eligible filers and authorized agents can use IRS TIN Match.

- No additional features like workflows, collaboration tools, or audit logs.

- May require pairing it with another platform for workflow and audit logs.

Best for: Any business that applied and is eligible to use the IRS e-service.

2. Compliancely

Real-time EIN Matching API

Compliancely is an IRS-authorized verification platform that verifies EIN in real-time within seconds. Beyond EIN verification, the platform also screens businesses against global watchlists, sanctions lists, and other risk databases.

Standout Features:

- All-in-one verification: Check and verify EIN/TIN and business info in one single workflow.

- Real-time results: Get your EIN verified in real-time in just 3 seconds.

- Bulk TIN match: Upload and validates large volumes of EINs in one upload.

- API Integration: Integrates into existing workflows for seamless automation.

- No Down-Time: Offers high availability with 9.999% uptime for 365 days.

Best for: Businesses that want EIN checks within their identify verification and tax compliance workflow.

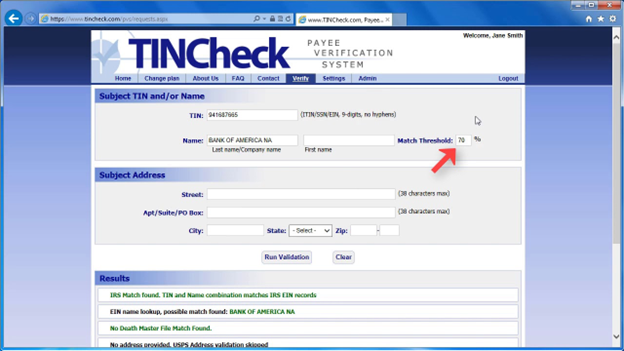

3. TINCheck by Sovos

Enterprise-Grade EIN Check

TINCheck by Sovos is an enterprise-grade, one-stop solution for tax identity verification. It offers real-time EIN/TIN verification against IRS data, while also screening records against 30+ global watchlists.

Standout Features:

- Scalable tools: Works well for larger organizations that requires web access, API, and bulk uploads.

- API Integration: Connects onboarding workflows and back-office systems for real-time identity checks.

- Flexible plans: Offers monthly or pay-as-you-go options for different business needs.

Best for: Enterprises that want EIN verification plus additional validations on a single platform.

4. Tax1099

EIN/TIN Match Built Into A Popular E-filing Platform

Tax1099 is an award-winning, IRS-authorized e-filing and TIN verification platform designed for businesses of all sizes. It not only does e-filing for 1099, W2, ACA forms, etc., but also offers real-time TIN matching with 100% accuracy.

Standout Features:

- Bulk filing & validation: Validate large volumes of EIN/TIN in a single workflow.

- TIN match API: API integration helps automate TIN checks, W-9 requests, and send real-time status updates.

- Simplified user access: No extra setup like OTP registration for employees or company phones.

Best for: Businesses filing 1099/W-2 forms that need built-in EIN/TIN verification within the same platform.

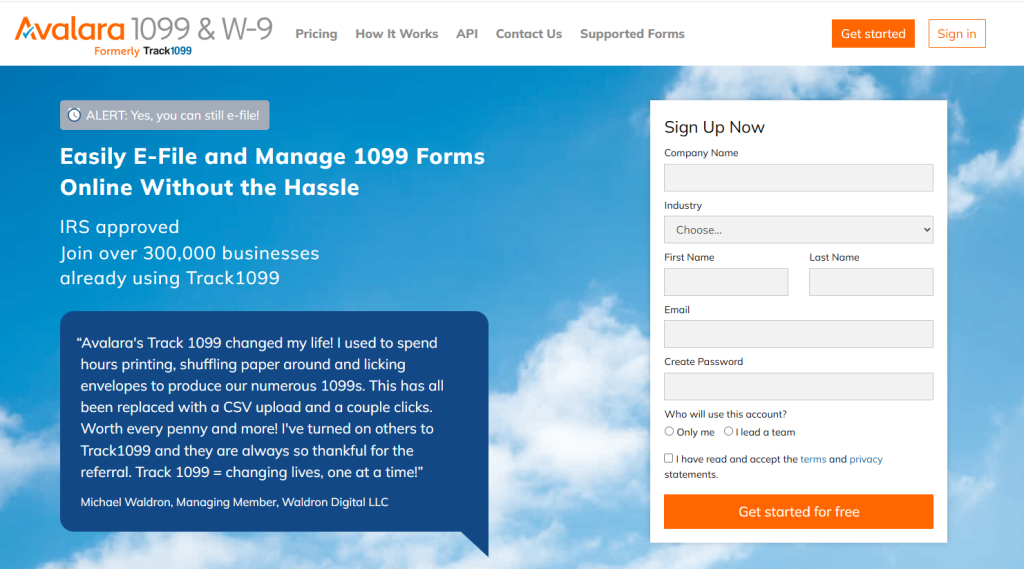

5. Track1099

Straightforward TIN Match Platform

Another EIN verification tool you can use is Track1099. Designed for teams that want a quick and easy TIN match process in their workflow, it offers a simplified TIN verification feature during e-filing checkout.

Standout Features:

- Easy to understand results: Gives EIN verification results using a simple pass/fail method.

- Built into filings: Get EIN/TIN check right before submitting your 1099s.

Best for: Small teams looking for a simple and straightforward way to reduce B-Notices with EIN verification.

How To Choose The Best EIN Verification Platform

| Tool | Best For | Key Considerations | Price |

|---|---|---|---|

| IRS TIN Match | Authoritative IRS validation | Free direct government access, official pass/fail results, requires IRS account setup and pre-filing only | Free (only for authorized users) |

| Compliancely | Unified vendor onboarding + identity checks | Real-time EIN validation, async APIs, webhooks for automation, and full audit trails useful for KYB/KYC and tax workflows | Starting at $19.95

for 25 matches per month |

| TINCheck by Sovos | Large enterprise compliance suites | Integrates with Sovos tax reporting products, includes IRS + vendor-sourced data checks | $24.95 per month Or $19.95 for a one-time charge |

| Tax1099 | 1099 filing + verification combined | Built into 1099 e-filing workflow, reduces mismatches, supports vendor onboarding, and aligns directly with IRS deadlines | Starting at $249 per year Or $0.37 per form |

| Track1099 | Small businesses with limited budget | Simple UI, easy pass/fail results, minimal setup required, affordable option but lacks deeper API integrations or features. | $0.45 per form |

When to Use EIN Verification Tools

1. Vendor onboarding check

When a new vendor is onboarded, one of the first things a business needs is to get the vendor to submit a Form W-9. The business will then use the information provided on the W-9 and run the EIN and legal name through an EIN verification tool. If the result fails under the TIN name match pass/fail rules, they can request for a corrected W-9 from the vendor again.

2. Bulk cleanup before filings

The finance or accounting team takes their entire vendor master file and runs a bulk EIN validation. If the results show that there is a mismatch, they can fix the error before submitting the forms to the IRS. This action helps reduce B-Notices with EIN verification.

3. Seamless API Integration

Some businesses integrate IRS TIN Matching for EIN/name into their systems via API and if an EIN fails during the verification process, the workflow automatically pauses to collect updated documents from the payee. This creates a secure EIN verification workflow that reduces the chances of errors.

4. Monitors changes to EIN data

Quarterly re-screens catch a legal-name update after a merger; records are updated so filings match IRS data.

If a team performs quarterly re-checks with EIN verification tools after a vendor’s legal name changes which was a result of a merger, the EIN verification tool can catch this error. It would then make it easier to update the records.

FAQs

1. Is EIN verification the same as TIN matching?

EIN is a type of TIN. TIN Matching is the process of verifying whether a legal name and TIN combination, which includes EINs, SSNs, ITINs, etc., matches IRS records.

2. Can the system tell me the correct EIN if there’s a mismatch?

No, TIN matching service provided by IRS e-services and authorized third party platforms do not provide the correct EIN if there’s a mismatch. To get the correct EIN, you need to collect updated Form W-9 from payee/vendor.

3. Who can use IRS TIN Matching?

Any eligible payers and IRS-authorized agents who file information returns can use the TIN Matching system.

4. Interactive vs. Bulk TIN Match—when to use which?

Interactive TIN Matching is best for small batch EIN verifications. It can only validate up to 25 records at a time. Bulk TIN Matching, on the other hand, is best used for large scale filings of up to 100,000 records.

5. Why store logs?

Storing audit logs with details on who requested verification, when, what was checked, and results helps makes audits and resolving notices easier and faster.

6. Do I need an API?

You can use APIs for bulk EIN match and real-time verification needs such as new vendor onboarding.

Start Real-Time EIN Checks Today

Integrate Compliancely’s API and verify TINs instantly across your onboarding process.