Approve the right customers faster, prevent income fraud, and stay audit‑ready

by

pulling verified earnings from IRS transcripts.

Conduct checks to ensure the income proof is authentic, legitimate, and issued by the government.

Get a fast, reliable view of an individual’s income profile, eliminating reliance on self-reported data.

Loan underwriting, credit card issuance, and mortgage approvals.

Policy underwriting (life, health, disability, business coverage).

Tenant screening, lease approvals, and rent-to-own agreements.

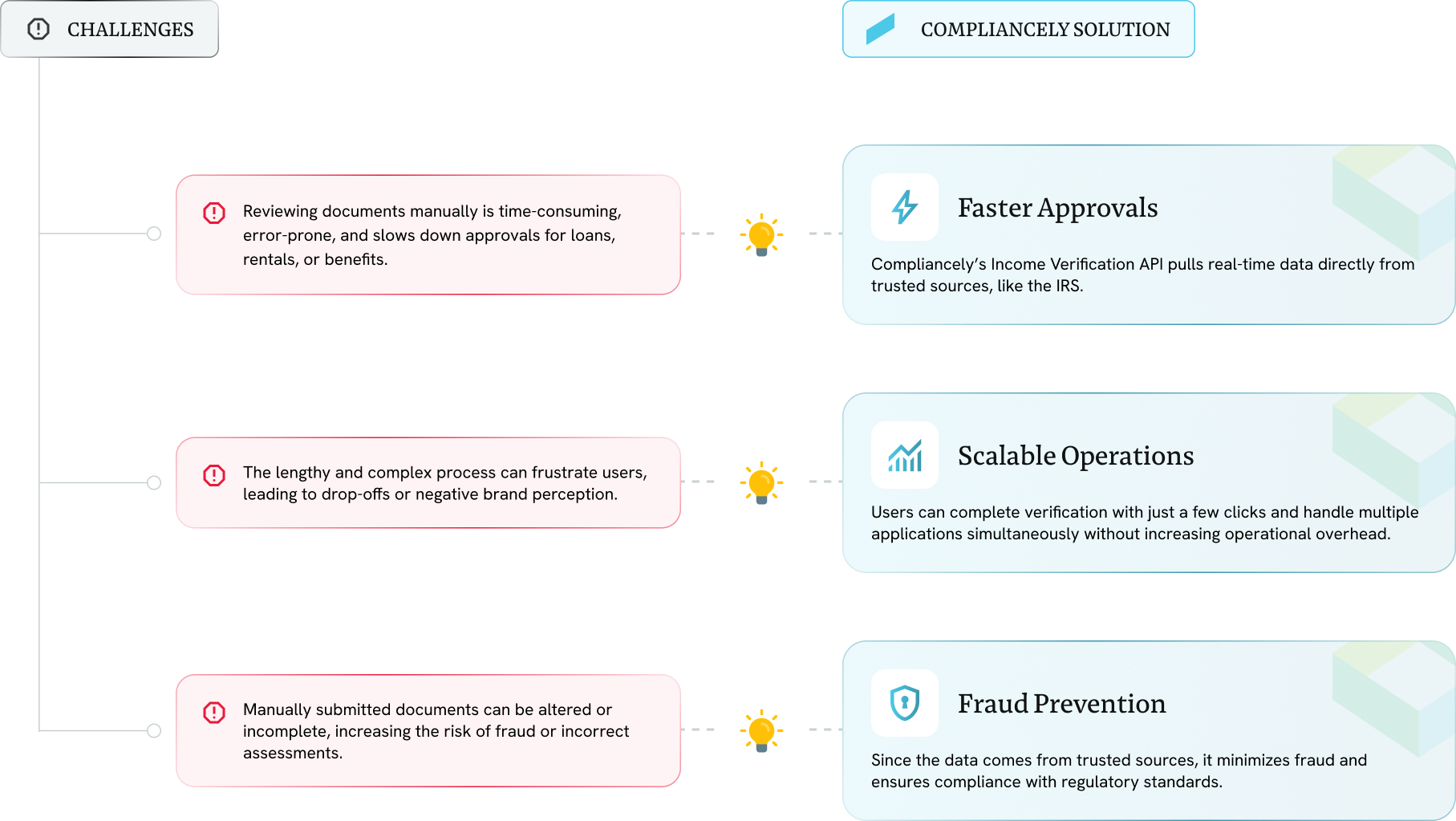

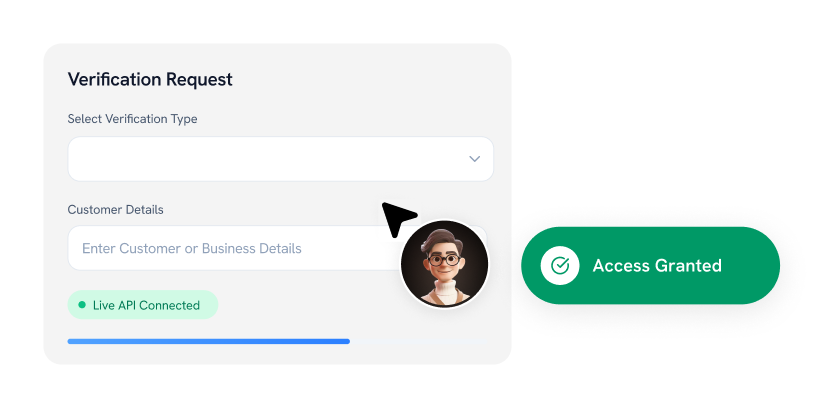

Compliancely offers a robust API for income verification, allowing you to confirm customer details and account ownership, facilitating your Know Your Customer (KYC) checks and lending decisions.

See how lenders, marketplaces, HR teams, and compliance leaders use Compliancely to move faster with confidence.

Lift in loan conversions with automated income data

Reduction in manual reviews with anomaly flags

Increase in approvals with verified income

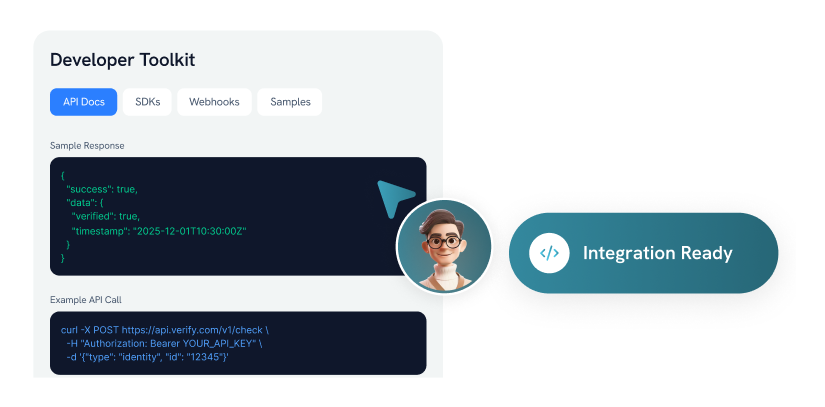

Streamline your KYC/KYB workflows with powerful, production-grade endpoints.

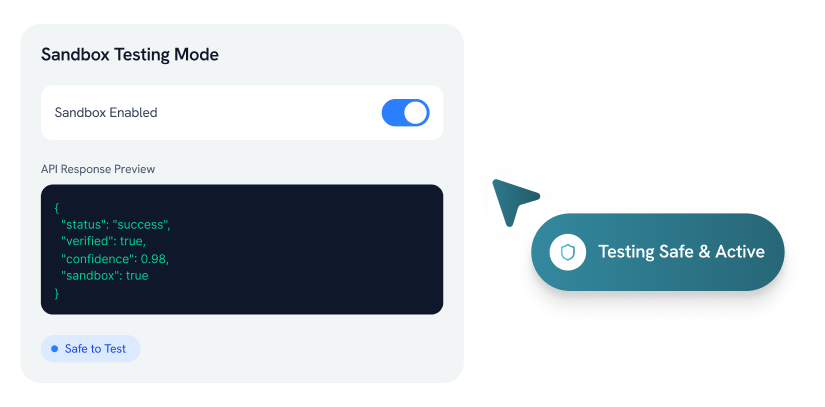

Test our APIs in a secure sandbox environment to ensure smooth functionality and integration.

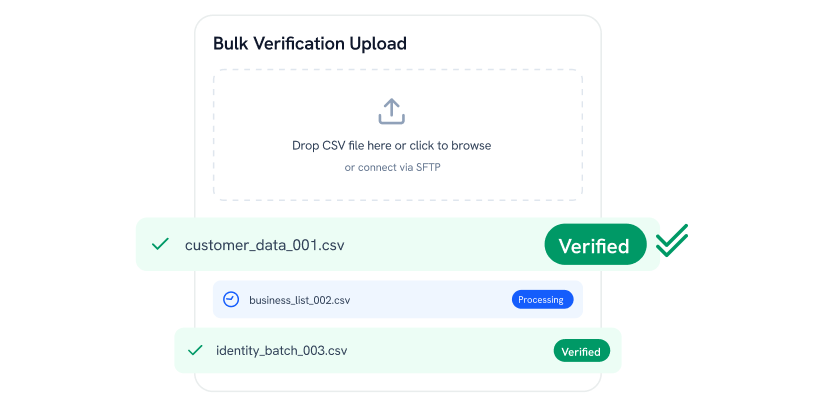

Upload data via CSV or connect via SFTP for high-volume processing, ideal for lenders, FinTechs, and government agencies.

Enjoy seamless integration with developer-friendly documentation, API/SDK snippets, webhook event triggers, sample JSON outputs for income summaries, and 24/7 expert support.