Verify and validate business entities using our automated KYB verification system. We use up-to-date data from multiple sources to verify business registration, tax IDs, and compliance status accurately.

Business verification (KYB) ensures the companies you work with are real, legitimate, and safe to engage, protecting you from fraud, regulatory penalties, financial exposure, and operational risk. Yet traditional KYB is often slow, manual, and incomplete. Compliancely changes that.

By combining data intelligence across 10+ verification dimensions with AI-driven insights and automated workflows, Compliancely delivers an instant, 360-degree view of any business so you can:

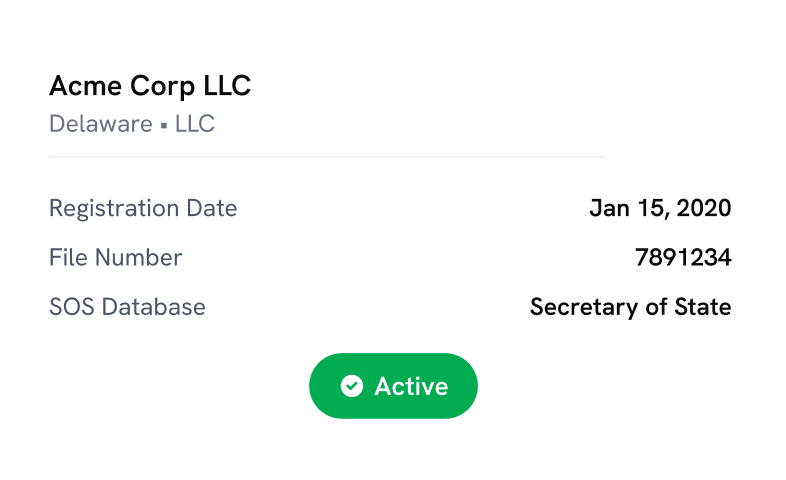

Get a complete business profile.

Global Verification Checks

Data Sources

Checks

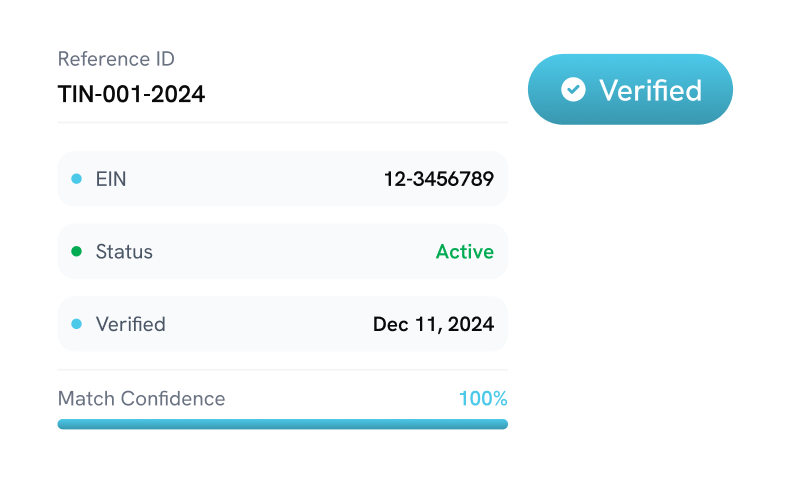

TIN Match Result

Uptime

We are built for teams that want a one-stop business verification platform.

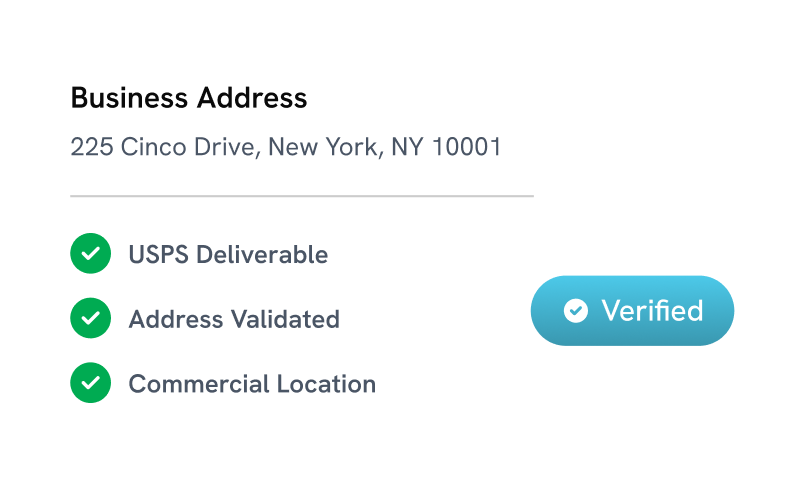

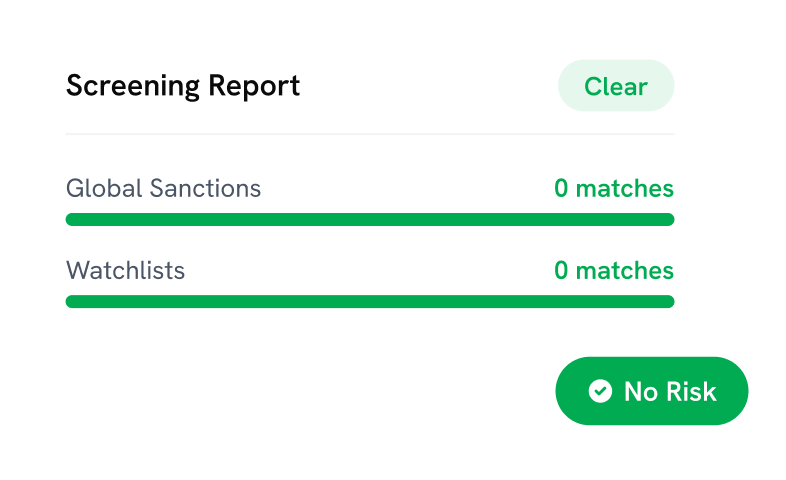

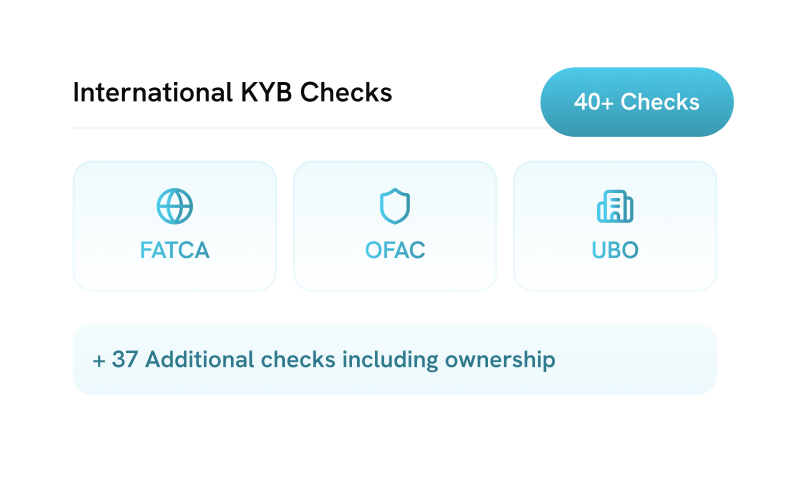

Verify business identity, run TIN/EIN checks, screen 40+ sanctions/watchlists, collect registration documents, for full KYB assurance from a single platform.

Access company registration, ownership details, financial standing, and compliance insights instantly.

Use our KYB API or batch uploads, with real-time webhooks to keep your systems instantly updated.

Stay informed with alerts whenever a business’s status, ownership, or compliance profile changes.

Keep complete audit logs, reviewer notes, and exportable reports for compliant records.

Tailor workflows, rules, and risk checks to your industry, region, and compliance requirements.

Everything You Need to Know

Business verification software is a tool that verifies a company’s identity, registration, ownership, compliance status, and risk profile.

KYB, short for Know Your Business, is the process of verifying a businesses’ identify before working with them.

KYC or Know Your Customer verifies people or individuals. While, KYB or Know Your Business verifies businesses and their owners.

Compliancely offers 40+ verification checks including TIN/EIN validation, SOS business registration checks, address verification, global sanctions/watchlist screening, liens checks, beneficial ownership verification, and more.

Yes, Compliancely offer 40+ international checks, global sanctions lists, and multi-jurisdictional compliance workflows for global business verification.