Gain consent-based insight into filing history, income behaviour, and tax risk signals, enabling confident underwriting, onboarding, and risk management across lending, insurance, and wealth.

Streamlined processes cut errors and empower smarter choices.

Reduced Manual

reviews

Increase in Approval

accuracy

Reduced Fraud

Incidence

Evaluate an individual’s tax compliance posture and income integrity to reduce financial, legal, and reputational risk with Compliancely’s Individual Tax Risk Assessment Reports.

Leverages authorized IRS individual transcripts (e.g., 1040, wage & income) via consented flows for accurate, authoritative insights.

Policy underwriting (life, health, disability, business coverage).

Flags high-risk indicators such as unpaid balances, filing gaps, and discrepancies between reported income and obligations.

Built for Lenders, Insurers, and Wealth & Advisory Teams

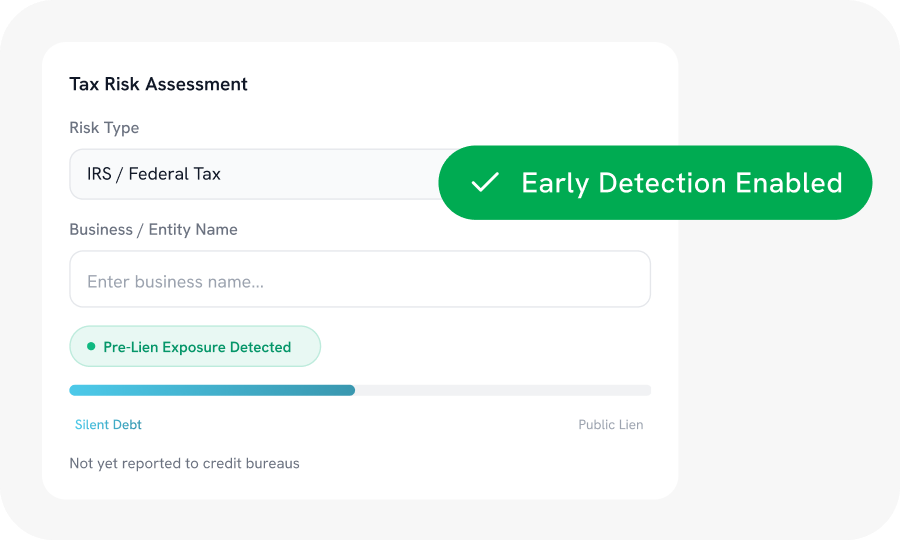

IRS debt exposure often exists well before public records reflect it. Proactive identification reduces downstream impact.

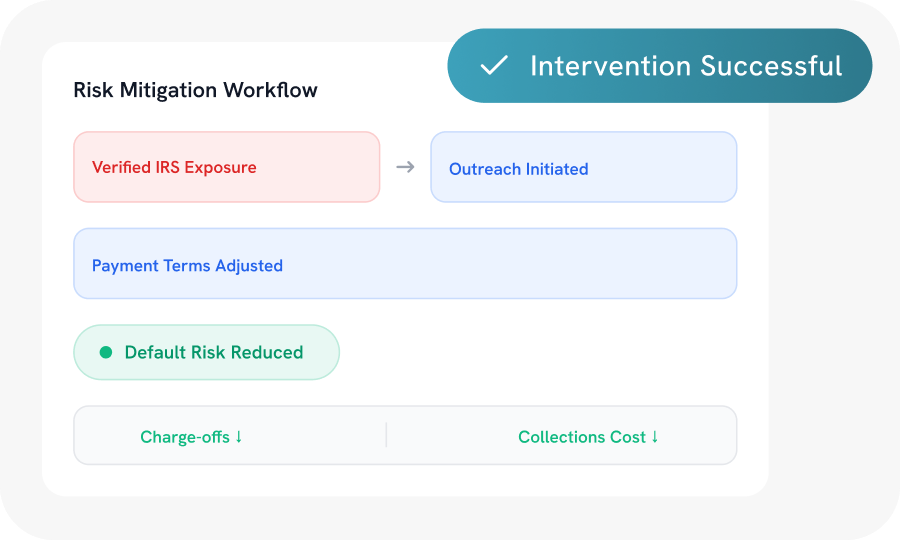

Identifying tax risk early enables proactive outreach and right-sized payment terms, reducing the likelihood of defaults and write-offs.

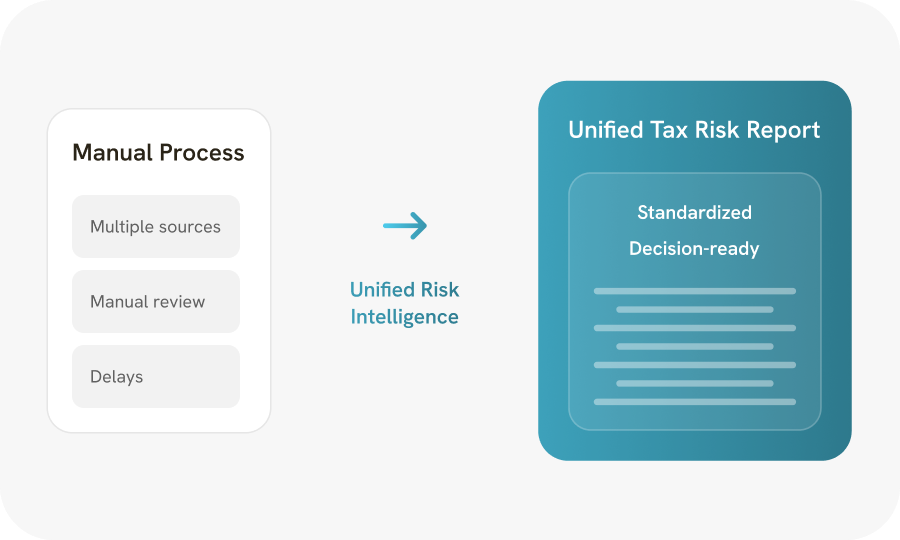

A single, unified tax risk report streamlines decision-making, helping credit and finance teams move faster with greater confidence.

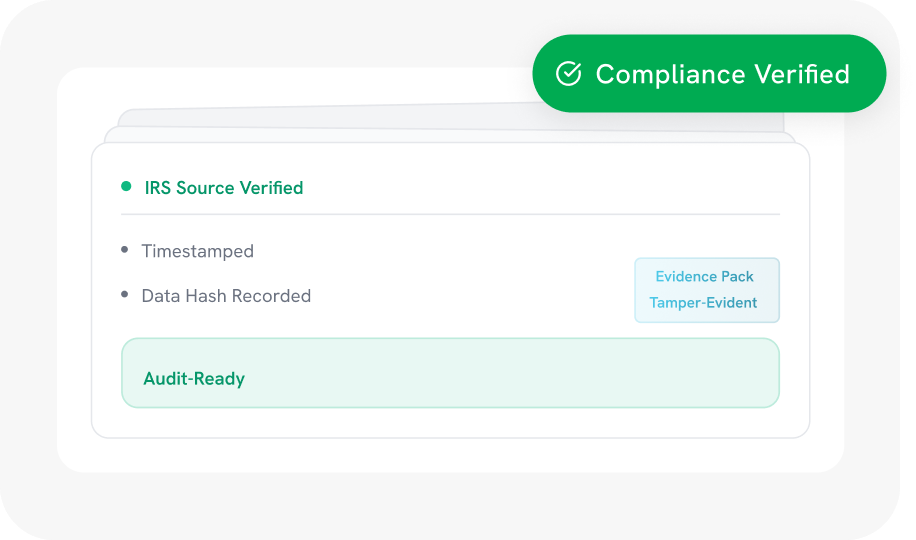

Each report includes a tamper-evident evidence pack to ensure transparency and audit readiness.

Submit a request via API, dashboard, or bulk upload, whichever suits your workflow.

We pull real-time IRS individual data and enrich it with public records.

Receive a decision-ready Individual Tax Risk Assessment Report.

Everything You Need to Know