Get a clearer view of credit risk by automatically retrieving critical business risk signals including liens, litigation, and bankruptcy.

In a traditional business credit assessment process, teams often spend hours gathering information from multiple disconnected data sources. This manual driven process is slow, time-intensive, and increases the chance of missing out on important risk signals before capital is deployed.

Make faster and more informed credit assessment decisions with Compliancely. You can automatically check whether a business is legitimate and highlight potential risks in one place. Instead of searching through multiple systems and records, teams get verified business information upfront.

By validating key business details, your team can catch any red flags including inconsistencies, inactive entities, or warning signs before extending credit. Catching these issues upfront helps avoid losses, write-offs, and time-consuming recovery efforts later.

Pull verified business data upfront from verified sources on a single platform. As a result, applications can move through the pipeline faster, shrink approval timelines, and make credit decisions sooner.

Instead of relying on self-reported data, your team can get a verified view of each business from legitimate sources. This gives you a clearer picture of whether the business is legitimate and whether there are known risks, such as liens or legal issues.

Every step in the credit assessment process is logged and traceable, creating a clear record of how decisions were made. This supports audits, internal reviews, and regulatory inquiries, without the need for last-minute data reconstruction or guesswork.

When credit reviews rely heavily on manual judgment, decisions can vary depending on who is reviewing the application or how information is interpreted. By having governed workflows in place, you can evaluate every applicant in the same way.

Simplify lien filing and termination across all 50 states by automating the process. Automation reduces manual effort, shortens loan processing timelines, minimizes filing errors, and helps ensure collateral is properly recorded throughout the loan lifecycle.

Build a full business profile by aggregating official records, registrations, watchlists, TIN checks, and other KYB data to confirm that the business exists, is currently active, and matches application details.

Automatically search for federal and state tax liens associated with a business and individuals associated with the business to minimize any potential default risk.

Search bankruptcy filings linked to a business to help assess financial distress, historical risk, and potential exposure before extending credit.

Review open and closed litigation involving a business and associated individuals to uncover legal risks that may impact creditworthiness or repayment capacity.

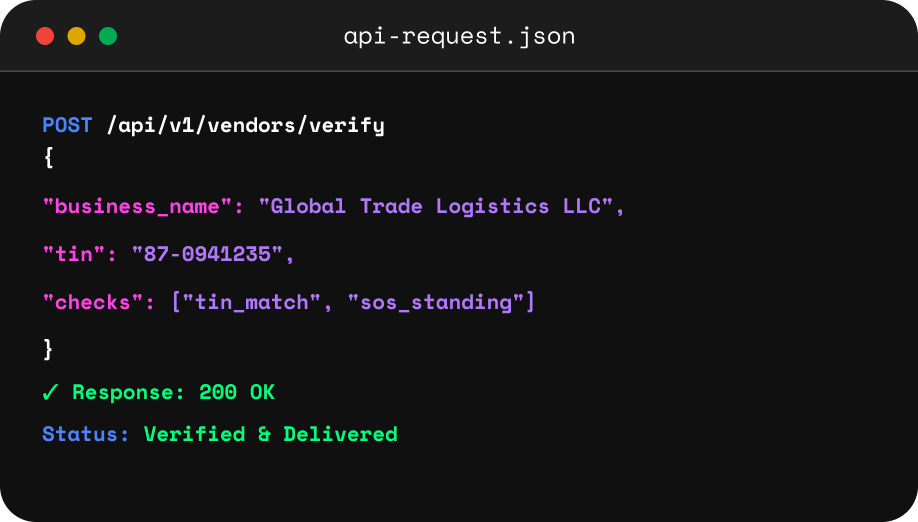

Automate credit risk workflows via APIs/webhooks, bulk uploads, and dashboards, combined with configurable risk rules and scoring.

Compliancely integrates into your existing credit, onboarding, and approval processes via APIs and configurable workflows. Instead of changing how your team works, our API runs verification checks automatically in the background during onboarding, contract approval, or account setup.