Gain a 360° view of business tax integrity- powered by government-source data that surfaces liens, levies, balances, and filing behavior with proactive alerts- via one API that unifies IRS tax transcripts, and AI analytics for data-driven credit decisions.

Evaluate a company's tax integrity and financial standing to reduce financial, legal, and reputational risks with Compliancely’s comprehensive tax risk assessment reports.

Leverages authoritative IRS data to ensure accurate identification of compliance gaps and audit risks.

Provides a 360-degree view of tax exposures across jurisdictions, business units, and transaction types.

Visually prioritizes tax risks by likelihood and impact, with area-specific scores that guide targeted mitigation efforts.

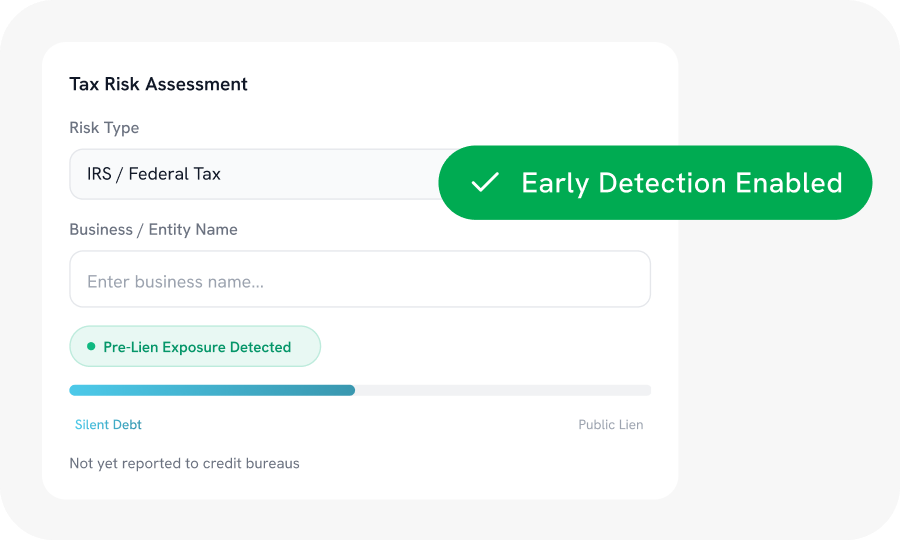

IRS debt exposure often exists well before public records reflect it. Proactive identification reduces downstream impact.

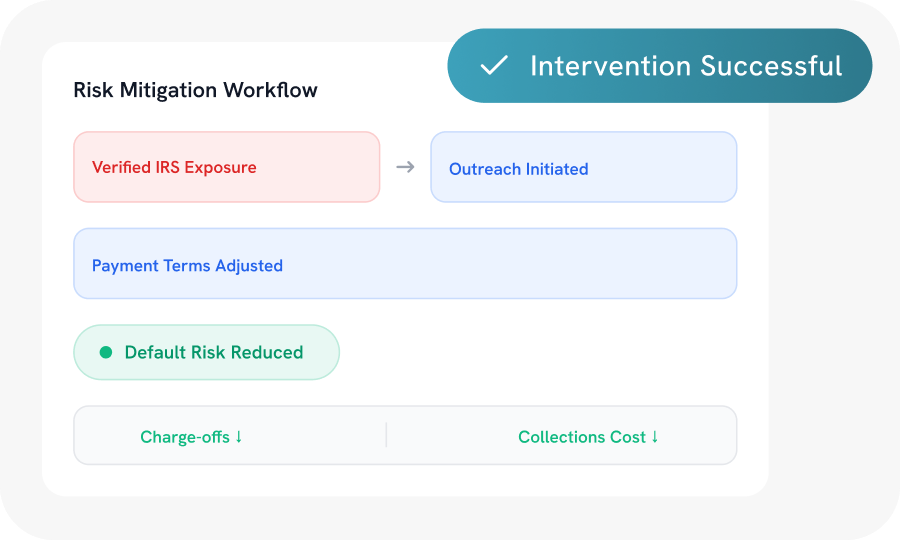

Identifying tax risk early enables proactive outreach and right-sized payment terms, reducing the likelihood of defaults and write-offs.

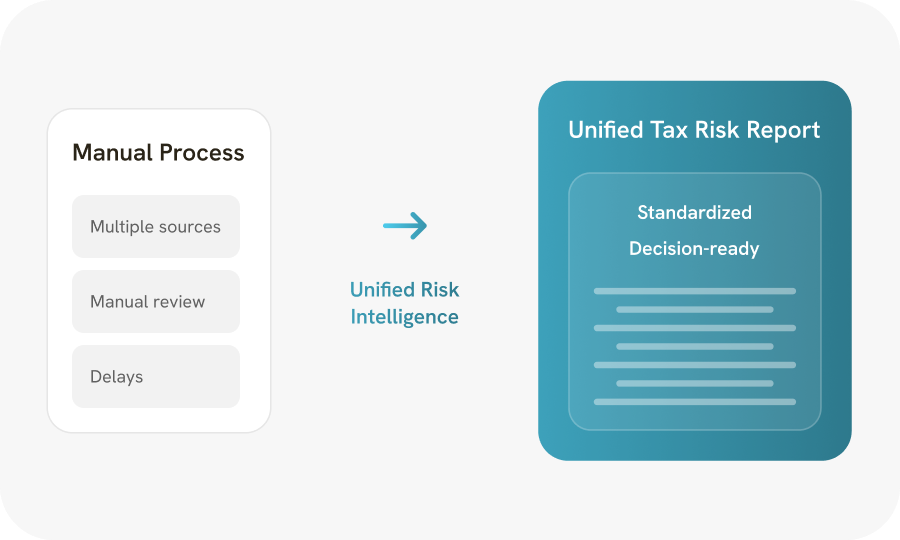

A single, unified tax risk report streamlines decision-making, helping credit and finance teams move faster with greater confidence.

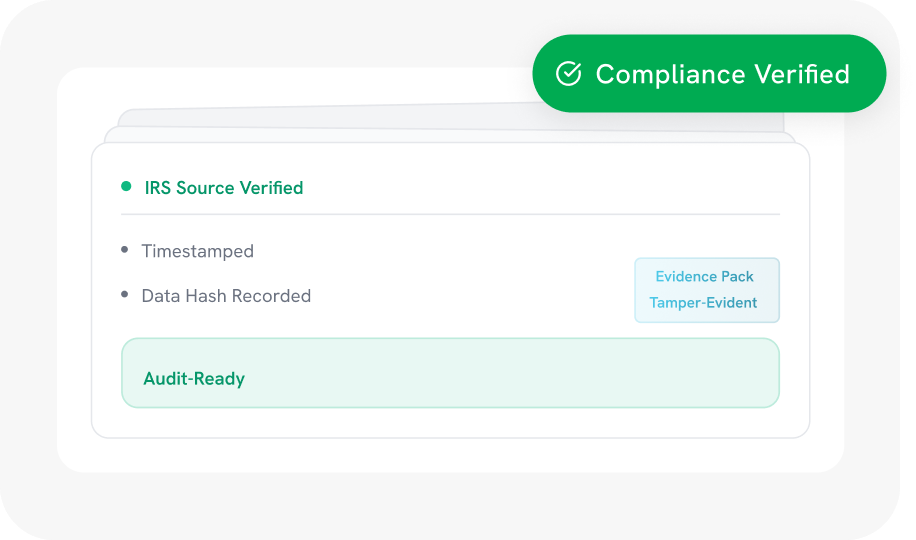

Each report includes a tamper-evident evidence pack to ensure transparency and audit readiness.

Submit a request via API, dashboard, or bulk upload, whichever suits your workflow.

We pull real-time IRS business data and enrich it with public records.

We generate a comprehensive risk profile with actionable insights.

Everything You Need to Know

Authorized individual tax transcripts and account data (e.g., 1040, wage & income, account records) via consented IRS-approved flows.

Yes. All individual tax data is accessed with explicit taxpayer consent, ensuring compliance and privacy.

Yes. IRS account signals can indicate unpaid balances or non-filing long before a lien appears in public records or credit bureaus.

We aggregate across jurisdictions; coverage matrices available.

Timestamps + “last updated” labels; webhook updates on re-pulls.

PDF evidence pack, JSON, CSV; API & bulk outputs.

No, Compliancely provides data & tools; customers make underwriting decisions.